child care tax credit 2020

The Child Tax Credit is worth up to 2000 for each dependent child under the age of 17 at the end of the tax year. It also now makes 17-year-olds eligible for the.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

You qualify for the child care tax credit as long as you.

. The percentage depends on your adjusted gross income AGI. How much was the Child and Dependent Care Credit worth in previous years. Up to 3600 per qualifying dependent child under 6 on Dec.

51 minus 2 percentage points for each 3600 or part of above 60000. Starting in 2021 the Child and Dependent Care Tax Credit became a refundable tax credit in contradistinction to a nonrefundable tax credit. W-2 wage income andor net earnings from self-employment andor certain disability payments was higher in 2019 than in 2020 you can use the 2019 amount to figure your Additional Child Tax Credit for 2020.

This tax season an often overlooked tax credit could put up to 8000 back in families pockets. The Keep Child. For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses.

The Child Tax Credit helps all families succeed. In the year 2021 following the passage of the American Rescue Plan Act of. A taxpayer who makes a monetary contribution prior to January 1 2020 to promote child care in the state is allowed an income tax credit that is equal to 50 of the total value of the contribution.

The Child Tax Credit provides money to support American families helping them make ends meet. For each child ages 6 to 16 its increased from 2000 to 3000. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

This credit maxes out at 1050 for one qualifying child under age 13 or 2100 for two or more kids. It also provided monthly payments from July of 2021 to December of 2021. For tax year 2020 the maximum amount of care expenses youre allowed to claim is 3000 for one person or.

Calculating the Child and Dependent Care Credit until 2020. For 2020 that would result in a 600 credit. 3000 for one qualifying person.

2020 tax year Additional Child Tax Credit ACTC Relief. Paying for childcare and dependent care can be. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

Youll need your caregivers taxpayer identification number. Combined with the 2021 child tax credit changes this credit can really help families better their finances. If you cant claim the Child and Dependent Care Credit or are looking for more ways to reduce your tax bill consider these tax credits and deductions.

Stimulus 30 increased how much you got from the child tax credit from 2000 per child ages 16 and younger to 3000 per child between ages 6 and 17. Official Code 47-180615. The act extends the credit for 5 more years.

Well assume you paid 8000 in qualifying child care expenses for an 8-year-old child each year. Ad The new advance Child Tax Credit is based on your previously filed tax return. In other words families with two kids who spent at least 16000 on day care in 2021 can get 8000 back from the IRS through the expanded tax credit.

Below the calculator find important information regarding the 2020 Child and Dependent Care Credit CDCC. To qualify for the credit your dependent must have lived with you for more than half the. For example if your income is 10000 your Ontario Child Care Tax Credit rate will be 75.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. Consider smart moves for any tax refunds. The child care tax credit was lower in previous years.

Formerly known as the Early Learning Tax Credit the District of Columbia Keep Child Care Affordable Tax Credit Schedule ELC is a refundable income tax credit that was enacted in the Fiscal Year 2020 Budget Support Act of 2019 effective September 11 2019 DC. Who qualifies for the Child and Dependent Care Credit. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

This credit has been greatly changed as part of the third stimulus plan or American Rescue Plan Act. Plus families were able to claim part of the credit as monthly payments for the second half of 2021 and get the rest at tax time. You must reduce the expenses primarily for the care of the individual by the amount of any dependent care benefits provided by your employer that you exclude from gross income.

The maximum amount of qualified expenses youre allowed to calculate the credit is. This means that if your income is such that you actually dont owe any taxes or because tax credits and tax breaks eliminate your tax burden you can still claim a CDCTC and receive a refund from the IRS. In 2020 the credit was worth up to 3000 for one dependent and 6000 for two or more dependents.

If your earned income eg. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The higher your income the smaller your percentage and therefore the smaller your credit.

IRS Tax Tip 2022-33 March 2 2022. You can find more details. Greater than 60000 and up to 150000.

For the 2021 tax year the child tax credit offers. Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8000. This temporary relief is based on the the Taxpayer Certainty and Disaster Tax.

Up to 3000 per qualifying dependent child 17 or younger on Dec. There is no upper limit on income for claiming the credit. In general for 2021 you can exclude up to 10500 for dependent care benefits received from your employer.

And 3600 per child under age 6. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. 59 minus 2 percentage points for each 5000 or part of above 40000.

File a free federal return now to claim your child tax credit. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent children. Prior to the American Rescue Plan parents.

Law 23-0016 and is codified in DC. It provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in. But for 2021 that would result in a 4000 credit.

This summary applies to.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

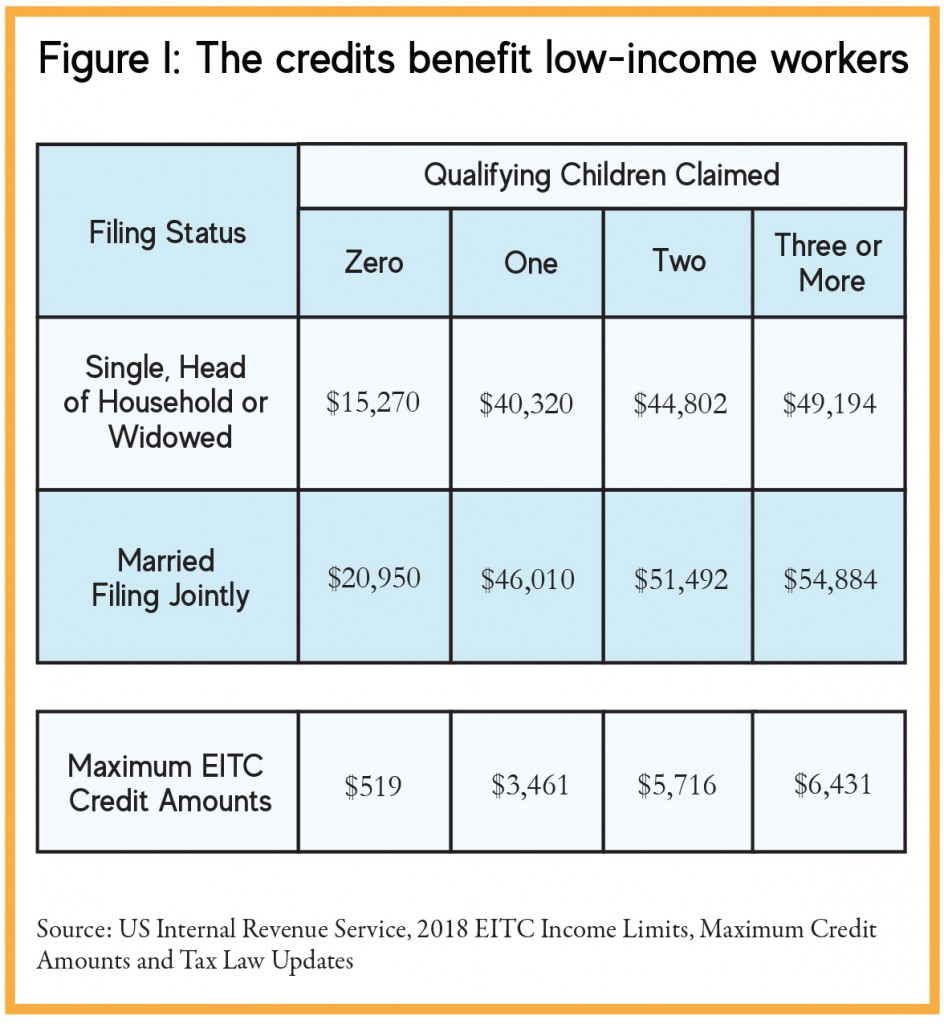

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center